Services

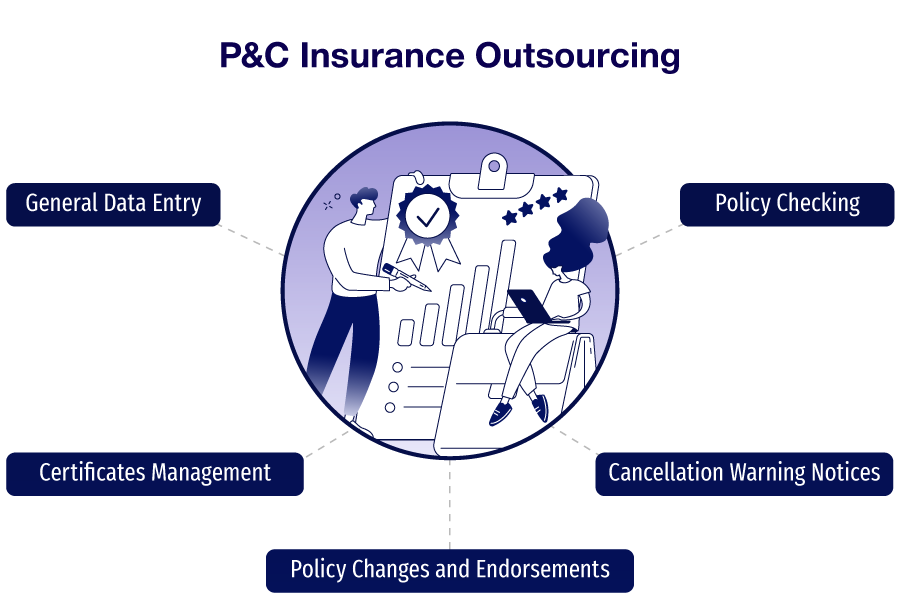

CLICKVISIONBPO is here to provide Insurance BPO Services for your insurance agency, ensuring a smooth operational workflow. Here’s what we can assist with.

General Administrative Support

General Data Entry

We handle all general data entry tasks with precision, ensuring that your agency’s information is consistently accurate and up-to-date. This frees up your team to focus on client engagement while we take care of the details behind the scenes as your trusted insurance BPO company.

Certificates Management

Managing certificates can be time-consuming, but we provide dedicated certificate management services. We ensure timely and accurate issuance of certificates, allowing your agency to stay compliant while focusing on growing your book of business through our insurance BPO services.

New Producer Book Conversion

When bringing on new producers, we handle the new producer book conversion by transferring and integrating their book of business into your agency’s system. This ensures a smooth transition and reduces administrative burdens for your team, enhancing your overall insurance outsourcing services strategy.

Applications Processing

Our team efficiently manages applications processing, ensuring all client information is entered, reviewed, and submitted correctly. By streamlining this process as part of our insurance BPO outsourcing services, we reduce delays and errors, helping your agency respond quickly to client needs.

New Business Data Entry

We handle new business data entry, ensuring that all new client and policy information is entered correctly into your system. This helps avoid errors in policy issuance, saving your agency time and improving client satisfaction through effective BPO services for insurance support.

Quoting and Proposals

Our team supports your agency by managing quoting and proposals for new clients. We provide fast, accurate quotes based on your underwriting guidelines, ensuring your agents have everything they need to win new business while leveraging our insurance outsourcing services capabilities.

Claims Services

Claim Tracking

Our insurance outsourcing services include precise claim tracking, ensuring every claim is monitored from submission to resolution. By providing timely updates, we help your agency maintain strong client communication and reduce delays.

Premium Loss Summaries

As part of our BPO services for insurance, we generate detailed premium loss summaries that give your agency a clear picture of client claim histories and loss ratios. This service allows for more accurate underwriting and informed renewal decisions through effective insurance BPO practices.

Claim Inputting

We handle all claim inputting tasks, entering essential details into your system quickly and accurately. This aspect of our insurance BPO outsourcing services ensures that claims are processed efficiently, minimizing administrative backlogs.

FNOL Processing

Our First Notice of Loss (FNOL) processing ensures that the initial details of a claim are accurately captured and submitted immediately. As part of our insurance BPO services, we expedite the claims process, improving your agency’s client service.

Claims Documentation and Validation

With our insurance BPO company solutions, we manage claims documentation and validation, ensuring that all required documents are gathered, reviewed, and validated. This service helps your agency minimize errors and ensures smooth claim processing.

Loss Runs Report

We handle the preparation and review of loss runs reports, providing comprehensive insights into past claims. This vital part of our BPO services for insurance helps agencies make informed decisions during underwriting and renewals.

Policy Administration Services

Endorsement Checking

Our insurance BPO services include thorough endorsement checking to ensure all changes to policies are accurate and compliant. We review each endorsement meticulously, saving your agency time and reducing the risk of costly errors.

Policy Delivery

Efficient and timely policy delivery is a crucial part of our insurance outsourcing services. We ensure that all finalized policies are delivered to clients promptly, helping your agency maintain strong customer relationships and service levels.

Cancellation Warning Notices

We manage the creation and timely distribution of cancellation warning notices, helping your agency stay ahead of potential policy lapses. This proactive approach, part of our insurance BPO outsourcing services, keeps clients informed and reduces cancellations.

Insurance Policy Checking

We provide comprehensive insurance policy checking as part of our insurance BPO support. Our team ensures that every policy document is correct and in line with underwriting guidelines, minimizing the risk of discrepancies or compliance issues.

Renewal Processing

Our BPO services for insurance handle all aspects of renewal processing, from generating renewal notices to ensuring accurate policy updates. This service helps agencies maintain retention rates and reduces the workload on internal teams.

Policy Changes and Endorsements

We take care of all policy changes and endorsements, ensuring that every update is processed accurately and efficiently. This service, included in our insurance BPO company support, allows your agency to focus on client growth while we handle administrative updates.

Get In Touch With Us

Outsourcing Process With New Clients

01

Initial Consultation

We begin by understanding your agency’s unique challenges and goals. During this consultation, we assess which of our BPO services for insurance will best fit your operational needs, ensuring we can deliver solutions that align with your business objectives.

02

Tailored Plan Development

After our assessment, we create a tailored insurance outsourcing plan that includes the specific services your agency requires, such as certificate issuance, policy checking, or claims processing. This customized approach ensures that every aspect of our support is designed to meet your goals.

03

Service Integration

Next, we integrate our team and processes with your agency’s existing systems. Our insurance BPO services are designed to seamlessly fit into your workflows, minimizing disruption and allowing for a smooth transition.

04

Training and Onboarding

To ensure the highest levels of efficiency, we closely collaborate with your agency on specific systems, procedures, and requirements. This step guarantees that all tasks, from quoting and proposals to policy renewal notices, are handled with precision and in line with your agency’s standards.

05

Implementation

Once onboarding is complete, we begin providing our services. Whether it’s managing certain insurance business outsourcing processes like policy renewals or processing loss runs, our team takes full responsibility for the tasks assigned, ensuring you can focus on core business activities.

06

Ongoing Support and Optimization

We monitor the performance of our insurance BPO solutions and make adjustments as needed. We schedule standard weekly or bi-weekly meetings to touch base and ensure both sides are on the same page. As your agency grows or your needs change, we collaborate to ensure ongoing efficiency and success.

Get in touch today

Offices

Address 1: Munkhättegatan 32, Malmö, Sweden

Address 2: 11ta Makedonska Divizija 15, Bitola, North Macedonia

Contacts

Phone: +1 (262) 262-7269

Email: bpo@click-vision.com

Co-Founder

Dimitar Talevski

Dimitar is a seasoned marketing specialist and the visionary behind CLICKVISION. With over 10 years in digital marketing, he excels in crafting marketing strategies that boost rankings, which in return increase leads, conversions, sales, profits, and ROI.

Co-Founder

Filip Dimitrijevski

With a strong background in the marketing industry and healthcare leadership roles, Filip is responsible for CLICKVISIONBPO’s sales strategies and onboarding new clients. With a passion for sharing insights gained from his experience, he also shares valuable knowledge through industry related articles.